Straight Through Processing of Insurance Claims

- Gavin

Can you build an app for straight through processing of insurance claims, including UI for necessary human interventions in a week?

The answer, surprisingly, is yes.

Of course, with software, it’s very hard to tell how long code takes unless you try. So we built one. The secret to our success was twofold:

- We had a semantic description of our domain, making the building of the UI almost completely automatic, and enabling logical description of entities

- We used a declarative logical description of the states of the insurance claim

So both the core logic of transitioning an insurance policy through states and the UI fell out of careful modeling of the problem domain. This is what declarative software design is supposed to do for us, and it worked so well that it even surprised me!

Best of all, it’s very easy to customize, because it is a very low-code application, with most of the logic in the description. I expect this approach can be used in a lot of FinTech applications and would love to have the opportunity to try it.

Demo App

We focused only on one use case: life insurance policies to demonstrate straight through processing of insurance claims with human intervention. Of course, our app doesn’t do everything that you might want in a fully-fledged insurance claims application.

However, it does do a surprising amount considering the time it took to put together, and with a bit of elbow grease it seems to me it could easily be a product in itself, and it could easily be grown out to deal with a much larger assortment of claims.

Modeling Insurance Claims

The first port of call is to model the objects of interest in claims processing. This is the semantic part that is going to drive the rest of the application.

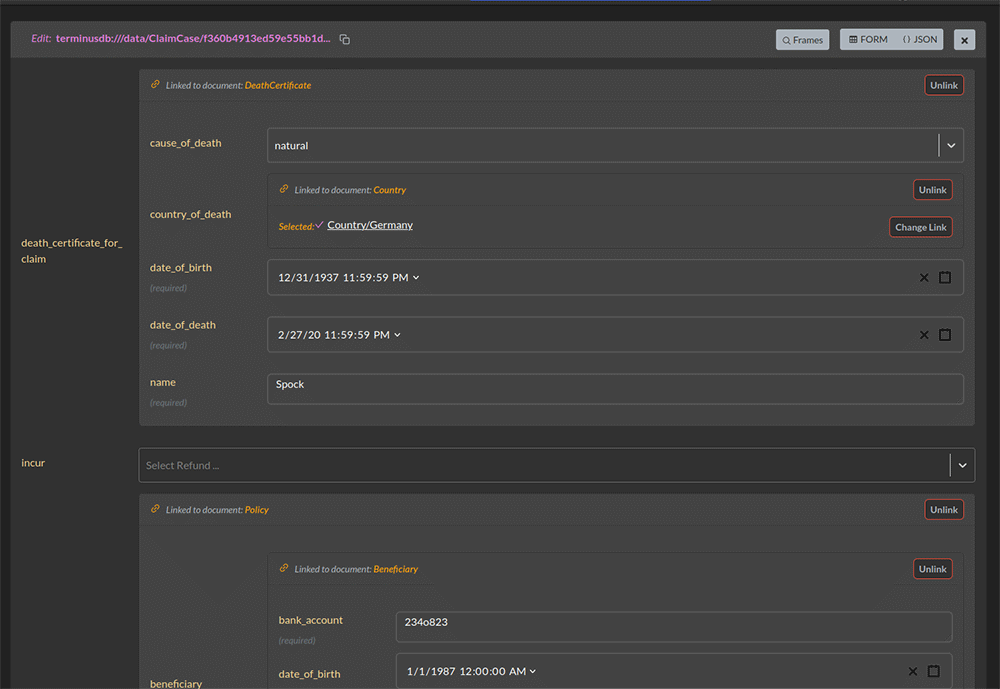

Our demo app has the following elements:

- Countries

- Claim Cases

- Policies

- Beneficiaries

- Death Certificates

It also has a couple of enumerated types:

- Refunds (Sum Assured, Premium or Denied)

- Cause of Death (Natural, Manslaughter, Murder, Accidental and Suicide)

The entire claim case model can be seen here.

Right out of the box, with this in place, we can get a default UI that looks like this:

This is what TerminusCMS gives us just by modeling our application domain. A nearly fully functional UI, which can then be customized quickly by passing JavaScript configuration objects in React.

Adding Declarative States

To make our straight-through processing system, we model the states of our system based on whether the object we are interested in meets certain constraints. That way the state of the object is defined by the content of the object, and changing the content of the object (for instance, supplying more information, or correcting information) will change it to a new state.

Let us take a concrete example:

{ "@comment": "Claim is eligible for a premium refund",

"@given": [

{ "death_certificate_for_claim": {

"date_of_death": {

"@var": "DateOfDeath"

}

},

"policy_of_claim": {

"moratorium_end": {

"@var": "MoratoriumEnd"

},

"moratorium_start": {

"@var": "MoratoriumStart"

}

}

}

],

"@has": {

"@ge": {

"@var": "MoratoriumStart"

},

"@le": {

"@var": "MoratoriumEnd"

},

"@with": "DateOfDeath"

},

"@noneOf": [

"ReferralForAssessment",

"ReferralForService",

"ClaimClosed"

],

"@on": "ClaimCase",

"_id": "PremiumRefund",

"_type": "Restriction"

}

What we are doing here is defining what claims are immediately eligible for a premium refund. The conditions which place a claim in this state are described declaratively. This is a business logical description that helps us move to the appropriate state automatically.

First, we must check to find the death date associated with the claims case, then we look for the start and end of the moratorium written into the policy.

Next, we check a condition, is the date of death between the start of the moratorium, and the end? If so, the person is only eligible for the refund of premiums made to date, and can not avail of the sum assured.

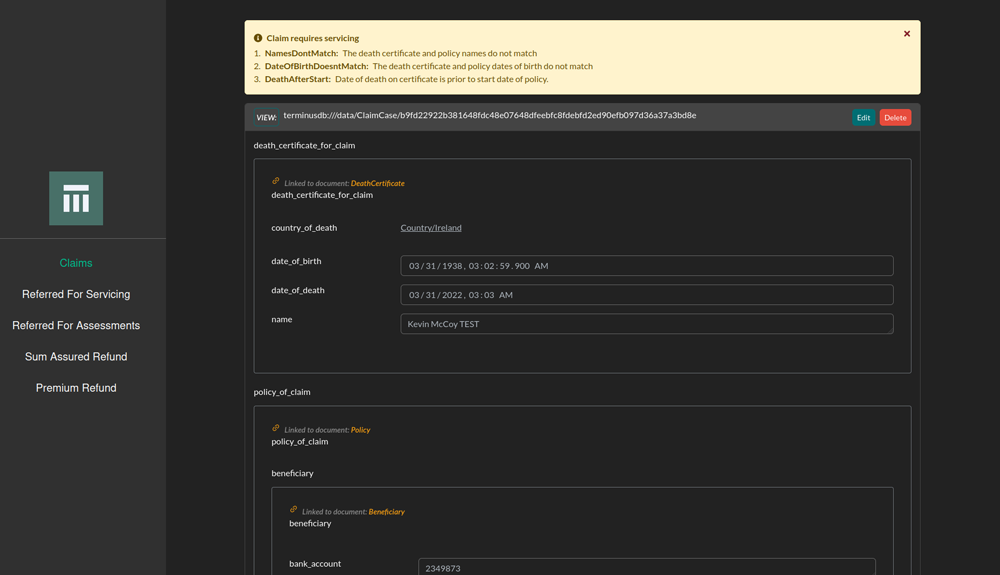

In addition, however, we have to check that the status of the record is safe in the sense that all necessary associated information has matched the conditions which place it into a referral for assessment or referral for service. These are conditions such as an unusual cause of death (perhaps murder), or failure for the death certificate to match policy details.

All of these other conditions are likewise written declaratively (as you can see from the above schema).

We also want to exclude those records for which the claim has already been closed (either due to a prior payout, or rejection).

Straight Through Processing Actions and the UI

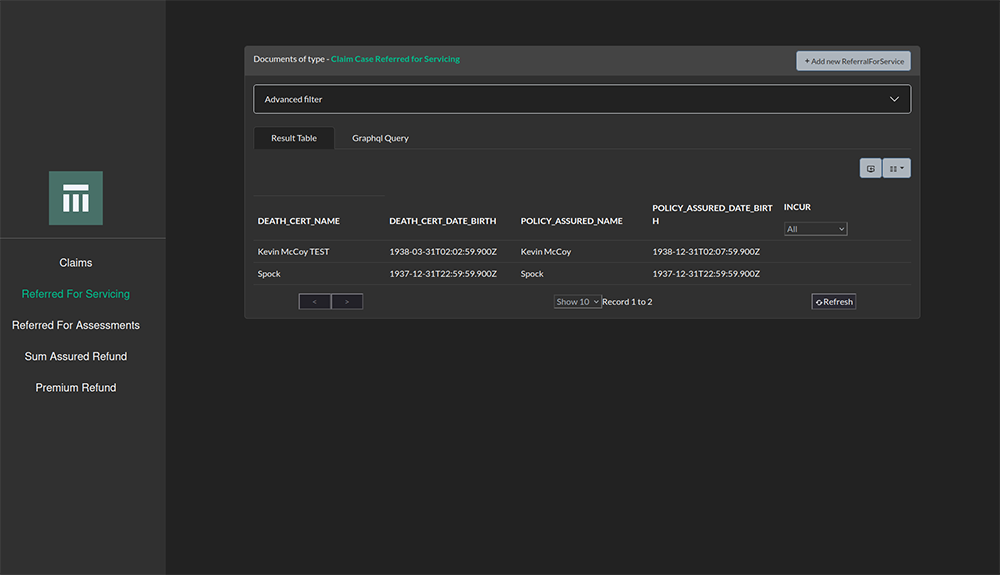

With these definitions which incorporate the relevant business logic, we can turn it into a fully-fledged application. We build React components automatically and expose a rich GraphQL interface that allows you to pull objects which meet a given restriction status easily.

If a premium payout status is reached, for instance, then we can have an automated procedure for payment, which then places the object in a closed status if successful. In fact, there may be many automatic procedures that take place, each moving the object into a further state which can ultimately result in the closure of the claim case or movement into some human interaction.

If an insurance claim is referred for servicing or some other state that requires human intervention, it will appear in a dashboard automatically.

The dashboard only refers to the state of the claim it would like to retrieve, in this case, referred for servicing. All of the query logic is entirely in the model. This means that as business rules change, nothing needs to change about the UI. Changes to the UI are only required when new insurance claim states are defined, saving time and reducing complexity.

When a user views a particular case state in the dashboard, we can tell the reason that it ended up in this state. This helps the human operator understand what needs to be altered in order to place the claim in a new state that no longer requires servicing.

Conclusion

Declarative domain modeling is exceptionally powerful as a means of writing low-code applications and implementing rules-driven functionality such as straight through processing of insurance claims.

Low code brings big benefits itself. It means easier maintenance, faster development time and more flexible business logic. This reduces costs of development and maintenance and improves agility, which is extremely important to respond to customer needs and competitors.